About Fortitude Financial Group

About Fortitude Financial Group

Blog Article

The 10-Minute Rule for Fortitude Financial Group

Table of ContentsHow Fortitude Financial Group can Save You Time, Stress, and Money.Fortitude Financial Group Fundamentals ExplainedFortitude Financial Group Can Be Fun For Anyone10 Easy Facts About Fortitude Financial Group ExplainedHow Fortitude Financial Group can Save You Time, Stress, and Money.

Note that numerous consultants will not manage your assets unless you satisfy their minimal demands (St. Petersburg Investment Tax Planning Service). This number can be as low as $25,000, or reach right into the millions for the most exclusive consultants. When choosing a financial expert, learn if the private adheres to the fiduciary or suitability standard. As noted earlier, the SEC holds all experts registered with the agency to a fiduciary criterion.The wide area of robos spans systems with accessibility to monetary advisors and financial investment monitoring. If you're comfy with an all-digital platform, Wealthfront is another robo-advisor alternative.

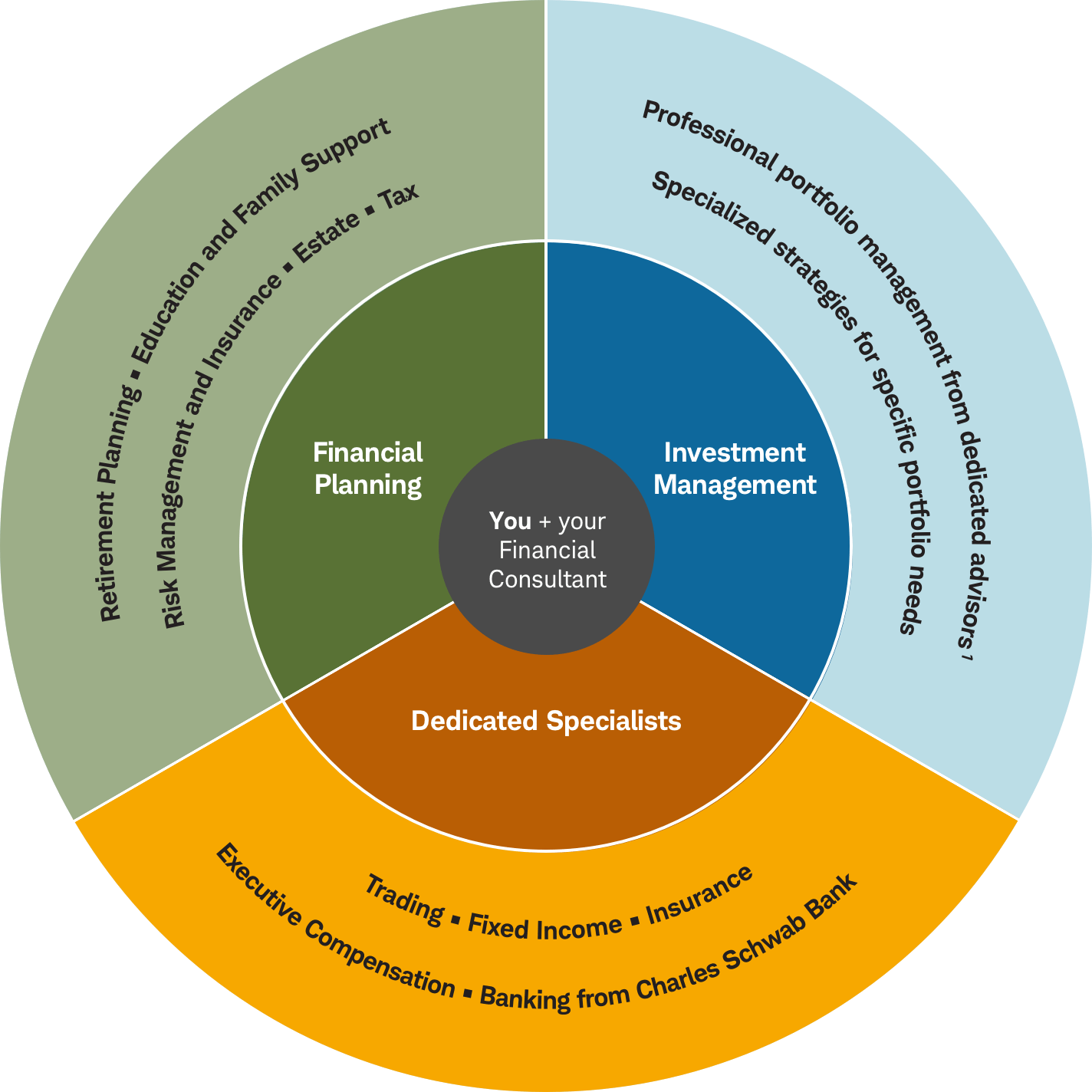

Financial consultants may run their very own company or they might be component of a larger workplace or financial institution. Regardless, a consultant can help you with whatever from building a financial plan to investing your cash.

Some Known Questions About Fortitude Financial Group.

Make sure you ask the right concerns of anyone you take into consideration employing as an economic advisor. Inspect that their certifications and abilities match the services you desire out of your consultant - https://www.blogtalkradio.com/fortitudefg1. Do you intend to discover more about financial consultants? Have a look at these posts: SmartAsset follows an extensive and thorough Editorial Policy, that covers principles bordering accuracy, credibility, editorial self-reliance, proficiency and neutrality.

Most individuals have some emotional connection to their money or the things they buy with it. This psychological connection can be a main reason we may make inadequate monetary decisions. A professional economic expert takes the emotion out of the equation by giving unbiased recommendations based on understanding and training.

As you undergo life, there are economic choices you will certainly make that could be made extra conveniently with the support of a professional. Whether you are attempting to decrease your financial debt tons or want to begin preparing for some lasting goals, you can take advantage of the solutions of a monetary consultant.

Some Known Details About Fortitude Financial Group

The basics of financial investment monitoring include purchasing and marketing financial properties and various other investments, however it is more. Managing your financial investments involves understanding your short- and long-lasting goals and making use of that details to make thoughtful investing decisions. An economic expert can give the information required to aid you expand your investment portfolio to match your wanted degree of risk and fulfill your economic objectives.

Budgeting gives you an overview to just how much money you can invest and just how much you should conserve monthly. Following a budget plan will assist you reach your short- and long-term monetary goals. An economic expert can assist you outline the activity steps to take to establish and preserve a budget plan that helps you.

Often a medical costs or home repair service can suddenly include in your debt tons. An expert financial obligation management strategy helps you settle that debt in the most monetarily useful means feasible. A monetary expert can assist you examine your debt, focus on a debt payment method, supply alternatives for financial debt restructuring, and detail an all natural plan to much better take care of financial debt and meet your future economic objectives.

Examine This Report on Fortitude Financial Group

Personal capital analysis can inform you when you can pay for to purchase a brand-new vehicle or exactly how much cash you can contribute to your financial savings monthly without running short for necessary expenditures (Financial Advisor in St. Petersburg). A financial expert can assist you clearly see where you invest your money and after that use that understanding to assist you recognize your economic health and exactly how to enhance it

Danger management services identify potential risks to your home, your car, and your family members, and they help you place the appropriate insurance plan in place to minimize those risks. An economic advisor can assist you develop a strategy to secure your earning power and decrease losses when unforeseen things take place.

Unknown Facts About Fortitude Financial Group

Minimizing your tax obligations leaves even more cash to add to your financial investments. Financial Advisor in St. Petersburg. A financial consultant can assist you utilize charitable providing and investment methods to reduce the quantity you have to pay in taxes, and they can show you just how to withdraw your cash in retired life in a means that likewise lessens your tax obligation burden

Also if you didn't begin early, college preparation can assist you put your child through college without facing unexpectedly large expenses. A financial advisor can assist you in understanding the finest ways to conserve for future college costs and exactly how to money prospective spaces, discuss exactly how to reduce out-of-pocket college expenses, and encourage you on qualification for monetary aid and gives.

Report this page